How do you know if you have a faulty strategy or a faulty execution? Or both? (Here’s how to fix it.)

Organisations cannot afford to have a faulty strategy, a faulty strategy execution, or both. Getting them right is vital for their survival especially in today’s crisis and economic downturn.

Businesses survive and thrive by taking risks. They falter when risks and opportunities are not managed effectively.

For organisations to execute their chosen strategy and achieve their strategy-focused objectives, risks and opportunities resulting from the implementation of their strategy must be differentiated from the risks and opportunities posed by the strategy itself. They do so by embedding risk management into their strategy planning and execution.

When risk management is effectively embedded in strategy planning and execution, corporate leaders will know the shortcomings of their chosen strategy while identifying those strategic objectives that may be at risk during their implementation.

Do you have a faulty strategy or a faulty execution? Or both?

I wrote about two potential problems corporate executives face:

- Inferior or non-implementable strategies that prevent organisations from effectively translating them into action and successes — This is referred to as the faulty strategy problem.

- Poor strategy execution or implementation that prevents organisations from achieving their vision and strategy-focused objectives — This is referred to as the faulty execution problem.

A rapid-cycle planning-and-execution approach is required to gain quick wins in strategy development, planning and execution.

I wrote about the following nine key principles that are related to the rapid-cycle planning-and-execution approach:

- Understand the dynamics that could affect success.

- Decide what outcomes you want to accomplish. This relates to your future-state visionthat sets the overall direction for your organisation. (To know why organisations need to do their corporate planning differently to survive and thrive in today’s challenging environment, go to https://executeastrategy.com.)

- Specify the behaviours that will help you win and succeed.

- Leverage people, processes and infrastructure for success. (To know more about the key skills and management styles required for ruthlessly executing your post-crisis strategies, go to https://executeastrategy.com.)

- Focus and prioritise resources to where they will have a significant impact.

- Create plans in real-time. Constantly improve them as you implement, learn and pivot.

- Use a campaign structure that focuses your efforts and resources.

- Execute rapidly and precisely in parallel. This where more strategic conversations are held.

- Know when and how to exit — your exit strategy. This is where you plan with the end in mind.

.

Embedding risk management into strategy planning and execution

Embed risk management into strategy planning and execution by linking Key Performance Indicators (KPIs) to Key Risk Indicators (KRIs). The tracking and monitoring of KPIs should be informed by KRIs.

When there are good linkages and relationships between KPIs and KRIs, risk management becomes an integral part of strategy planning and execution. This can overcome the faulty strategy problem and the faulty execution problem.

The difference between KPIs and KRIs

Key performance indicators help to measure performance against a chosen strategy, while key risk indicators help to quantify risks, or known uncertainties, and opportunities associated with the achievement of strategy-focused objectives.

Key performance indicators and measures are used to understand how well organisations are performing against their chosen strategy.

Note — A measure measures something (direct and accurate), while an indicator indicates something (indirect, requires interpretation and explanation).

Key risk indicators help to measure how much risk and opportunities they are exposed to when achieving their objectives. They quantify and monitor the risks and opportunities an organisation is exposed to when implementing their strategy.

By measuring the risks and their potential impact on business performance, organisations can create early warning systems that allow them to monitor, manage and mitigate key risks. In doing so, they increase their likelihood of achieving their objectives and bring their strategies to life.

Think of it this way:

- KPIs answer the question, “How are we doing against our future-state vision and goals?”

- KRIs answer the question, “What might prevent us from achieving our future-state vision and goals?”

For example, an organisation may have a KPI to monitor its market share growth as part of its strategy to grow revenues. Linked to that revenue growth strategy is a KRI to measure the potential risks of losing market share due to shifts in customer preferences or entry of new competitors.

In essence, KPIs help organisations understand how well they are performing to their strategy itself. On the flip side, KRIs help them understand the risks and opportunities involved and the likelihood of not fully executing their chosen strategy.

It is, therefore, important to integrate KRIs into your performance management framework by linking KRIs to KPIs. By establishing the right KRIs for your business and monitoring your ongoing performance through related KPIs, you can effectively track both your performance and risk in one streamlined process.

KPIs must, however, be distinguished from a Key Result Indicator. Using a car analogy, the speed of the car is travelling is a result indicator, while a performance indictor will show how economically the car has been driven. For example, in terms of distance travelled per unit of petrol or gas.

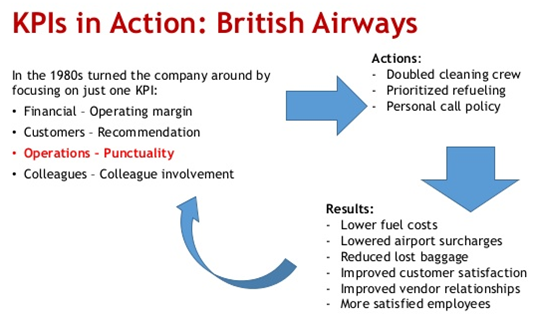

How one KPI turned around British Airways

On-time performance is one of the most important key performance indicators for the airline industry.

It’s worth noting that the word “key” is important here. KPIs aren’t about monitoring every single business performance. Instead, focus on the most critical indicators and measures for improving performance.

Late planes may increase the following and impact other aspects of operations and profitability:

- Airport surcharges.

- Cost of accommodating passengers overnight due to late-night noise restrictions.

- Customer dissatisfaction due to missed connecting flights and delays.

- Employee dissatisfaction due to constant firefighting and dealing with frustrated customers.

On-time performance was used as the main KPI during British Airways’ turnaround and successful privatisation in the early 80s when Sir John King led British Airways from 1981. At that time, British Airways initials were said to stand for “Bloody Awful”.

Focus on ONE critical success factor

John King focused on the timely arrival and departure of planes. It was the only Critical Success Factor (CSF) for him.

By focusing on one CSF and implementing the right KPIs and operational performance measures, British Airways was able to change its culture and fix a whole range of issues within the organisation. King was credited with transforming the loss-making airline into one of the most profitable airlines.

KPIs are vital for strategic decision-making and cultural change, as shown in the figure below.

British Airways then went on to boldly claimed to be “The World’s Favourite Airline” until 1993!

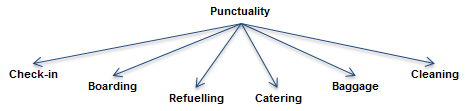

It is important to note that timely arrival and departure of planes CSF sat above all other success factors within a hierarchy, as shown in the figure below.

Finding the right CSFs and narrowing them down to no more than five to eight is a vital step that is seldom performed.

.

Ask your customers if you have the right strategy

Your customers will tell you whether you have the right strategy or not. They will also tell you whether you have a faulty strategy that needs fixing.

The World Airline Awards, which began in 1999, is an annual airline customer satisfaction survey for various aspects of travel experience, across both the airport and onboard environments.

This annual airline ranking is a Key Result Indicator for many airlines. Being at the top of that ranked list is a badge of honour for many airlines. The publicity and marketing that comes from being nominated as one of the top airlines can most certainly translate to revenue growth.

If you aspire to be the “The World’s Favourite Airline” and your customers don’t think so, then you have problems related to a faulty strategy and strategy execution.

Concentrating on one important goal that has the greatest impact

Instead of giving mediocre effort to dozens of meaningless goals, effective execution must start with the concentration on one important strategy-focused goal at a time.

An ideal strategy-focused goal that directly relates to the timely arrival and departure of planes CSF is increasing the percentage of planes departing on time from 80% to 90% by December 20XX.

Focusing on this one primary but strategic goal will ensure that everyone in the organisation is fully committed to achieving this one strategy-focused goal within a given period. It also sets a clear understanding of what is expected and required to be done in terms of priority of work and resourcing.

Use future-focused measures to drive performance

The timely arrival and departure of planes CSF are then measured by a handful of past, current and future-focused performance measures. But measure the wrong things, you will likely get the wrong behaviours.

Three types of performance measures that relate to the goal of increasing the percentage of planes departing on time from 80% to 90% by December 20XX:

- A past performance measure (or lag measure) is the number of late planes last week — This backwards-looking measure tells you if you have achieved your goal over the past week. A lag measure is a result that you were trying to achieve.

- A current performance measure is the number of planes that are more than two hours late. This measure is continuously being updated. It is current and can be managed proactively as the day progresses.

- A future-focused performance measure (or lead measure) is the number of projects completed over the next two months targeted on areas that are causing late plane departures. This forward-looking measure tells you if you are likely to achieve your goal. The achievement of this measure should be within your control. If this future-focused measure changes, you can confidently predict that your lag measures will also change when it is measured the following week.

Future-focused performance measures are most connected to the accomplishment of your goal. They foretell your results if chosen correctly. Identify the most important activities that will influence or move these future-focused measures towards goal attainment.

Unfortunately, it is easier to focus on lag measures because data on lag measures are easier to obtain. It is also more visible than data on lead measures.

Align all other performance measures

All other performance indicators and measures worked together to fully support that one CSF and one goal — pilots, flight attendants, cleaners, caterers, baggage handlers, front desk staff, etc. must all cooperate at the operational level to ensure that planes take off on time while maintaining or improving service standards.

The primary strategy-focused goal of getting plans to depart on time can be ‘broken down’ or cascaded as operational, reoccurring or immediate objectives and performance measures for various teams to achieve.

By doing so, all teams throughout the organisation can align their team objectives to effectively support this one strategy-focused goal within a hierarchy. They can all collectively deliver timely arrival and departure of planes.

Identify risk events that may prevent us from achieving our goal

Identify and access risks, or uncertain events, that may prevent you from achieving your goals, objectives or performance measures.

Risk events that may cause planes to be more than two hours late (a current performance measure) include:

- Systems failure.

- Airport disruptions.

- Flight diversions.

- Aircraft failure.

- Ineffective ground handling operations.

- Aircraft operated by inappropriately qualified aircrew.

- Flight delays or cancellations (no aircraft or aircrew available).

Note — When a risk is construed as an event, it becomes relatable and manageable.

Identify root causes of risk events

For any given risk event identified, there could be multiple root causes.

Root causes tell us why an event occurs. By identifying the root causes of a risk event, they provide valuable information about what triggers a loss or where the organisation is vulnerable.

Mitigation activities should be aimed at the root causes.

For example, a risk event may be that you constantly have headaches. One way to overcome a headache is to take a painkiller. While painkillers can make the headache go away, it does not help prevent future headaches. Painkillers may only treat the symptom, not the cause. To prevent headaches from coming back, you need to know the root causes of why you have them. If headaches are caused by a lack of sleep, then you should try going to bed earlier and have the required amount of sleep.

Armed with the knowledge of the source of a risk, you can proactively manage the risk and avoid future risk events from occurring.

When flights are diverted, there is a chain effect on future departures. There is a likelihood of flight delays.

The root causes of why flights could be diverted include:

- Sick passenger.

- Unruly passenger.

.

Use risk indicators to monitor the root causes of risk events

Think of key risk indicators as an early warning system. It is like an alarm that goes off when the organisations’ risk exposure exceeds predetermined tolerable levels.

KRIs can be measures used by organisations to provide early-warning signals of potentially increasing risk exposures.

They should be specific, predictive and easy to quantify through hard numbers, percentages or ratios (metrics). These risk exposures may impact on the achievement of your strategy-focused goal and the execution of your chosen strategy.

It’s worth noting that the word “key” is also important here. KRIs aren’t about monitoring every single risk facing the business. Instead, they focus on the most critical indicators for managing the highest risks.

When you know that the lack of sleep will cause you headaches, a good risk indicator to use is the number of sleep hours. If you have slept less than the risk tolerance level of say six hours, then there will be a high chance that you will experience a headache later during the day. This risk tolerance level, or risk metric, has been identified based on your past experiences of having headaches.

Note — A metric is a figure that provides an easily interpreted sign of performance.

For an airline, knowing the information about potentially sick passengers on board previous flights can trigger the appropriate actions to get future flights back on schedule again. A risk indicator could, therefore, be the number of known sick passengers on a flight.

Solve the two problems by integrating performance and risk management

Going back to the beginning, there are two problems corporate executives need to identify, monitor and overcome.

The faulty strategy problem could be solved by asking your customers about your performance against your stated future-state vision.

In the case of British Airways, it was to aspire to become “The World’s Favourite Airline”. When you have been independently ranked №1 airline by your customers, you truly know that you have been effectively doing the right things to execute the right strategy.

Use the right set of key performance indicators to give you the required information about your actual performance.

The faulty strategy execution problem could be solved by using the appropriate root cause focused risk indicators. These indicators provide valuable triggers for action taking especially when pre-specified tolerance levels have been breached.

Alarms will sound if performance falls behind expectations. This gives you the opportunity to redirect your effort. When performance results come in so far below the target and there’s nothing that can be done to salvage the situation, it is time to implement an exit strategy sooner rather than later.

This is where some performance indicators may also give you information about the implementation progress of your strategy.

All these information sources can help you take the appropriate actions to stay on course for success. They guide your performance. They provide the necessary course correction so that you can successfully execute the right strategy.

There are four steps for doing so:

- Step 1 — Define the business strategy through a set of measurable but executable strategy-focused goals and objectives that are linked to a handful of critical success factors.

- Step 1 — Define the business strategy through a set of measurable but executable strategy-focused goals and objectives that are linked to a handful of critical success factors.

- Step 2 — Establish key performance indicators and measures based on expected performance and improvements for the chosen strategy-focused goals and objectives. Rigorously track their performance. Always get your customers to feedback about your performance. Immediately address any faulty strategy problem and get back on track.

- Step 3 — Identify critical or strategic risk events and their root causes that can drive variability in the actual performance of your chosen business strategy, for better or worse.

- Step 4 — Establish key risk indicators and measures and risk tolerance levels for the root causes of critical or strategic risk events. Rigorously monitor their performance levels. Immediately address any faulty strategy execution problem to achieve your strategy-focused goals.

Unfortunately, many organisations perform Steps 1 and 2 through their strategic planning process. They then report the results to their executive committee and full board. Separately, they perform Steps 3 and 4 through their risk function. They report those results to their risk and audit committees. These oversight and accountability operate in silos.

Therefore, the key to solving the two problems is to integrate both performance and risk management practices into a coherent system and process. They should not be disparate or siloed. By doing so, it accelerates performance and growth.