How to implement a strategy-focused integrated management system that significantly improves organisational performance – A CEOs practical guide

Organisations use different management systems to provide the required foundation to direct and control their activities to achieve their objectives.

A management system is a set of interrelated or interacting elements that establishes the appropriate policies and objectives, as well as processes to achieve the organisation’s objectives. Efficiency is gained by having one, integrated system of management.

When the organisational structure is complex, the organisation needs to develop a robust, practical, yet simplified, integrated management system. This integrated system will fully integrate all relevant management practices and common touchpoints of the business into one coherent and synchronised management system. In doing so, it enables and drives the achievement of its corporate strategy and improve or drives performance.

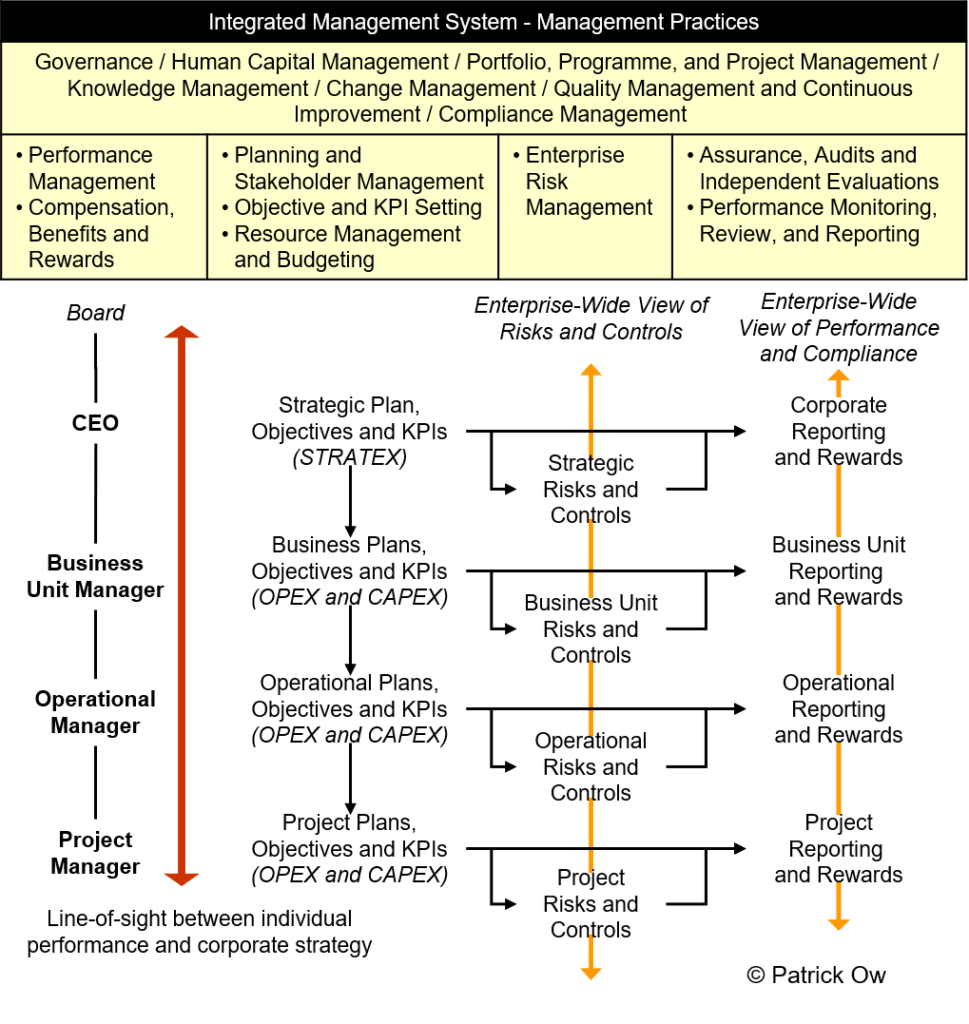

The integrated management system for effective strategy execution and improved organisational performance will comprise the following management practices:

- Governance

- Planning and stakeholder management

- Objective and key performance indicator setting

- Portfolio, programme, and project management

- Resource management and budgeting

- Enterprise risk management

- Human capital management

- Knowledge management

- Assurance, audits, and independent evaluations

- Performance monitoring, review, and reporting

- Performance management

- Compensation, benefits, and rewards

- Change management

- Compliance management

- Quality management and continuous improvement.

Instead of ‘silos’ of disparate systems and practices, this is a genuinely co-ordinated and synchronised system – it is greater than the sum of individual parts.

Collectively, these individual parts are achieving more than ever individually in terms of their overall performance and effectiveness.

Integrating is about understanding the common but essential elements or touchpoints of each management practice, its context, purposes, and objectives, and combining or integrating them into a single coherent, integrated management system. This ensures that the integrated system fully supports and complements each other for the sole purpose of achieving the organisation’s objectives and key performance indicators.

Integration does not simply involve introducing established and standardised management tools and processes into existing management systems. It requires the adaptation and alteration of those tools and processes to suit the needs of decision-makers and their existing processes for decision-making.

The integrated management system creates common tools, syntax, data structures, processes, and measures for effective strategy execution. These management practices are a means to an end that should be utilised and maximised strategically for both organisational and individual performance.

The benefits of implementing a strategy-focused integrated management system include:

- Ability to create unified objectives and to focus on achieving them.

- Reduced cost through reduced duplication and maximisation of effort and resources.

- A greater understanding of common control and regulatory requirements.

- Defined boundaries and accountabilities around unique roles, responsibilities, and accountabilities.

- Increased effectiveness of timely decision-making.

- Enhanced levels of organisational harmonisation, alignment, and synchronisation, leading to increased productivity, quality outcomes, and improved performance

- Enhanced stakeholder satisfaction through more effective communication, interaction, and confidence in the strategy execution process and organisational performance.

Tailor or customise these management practices to the organisational context and maturity. Organisational governance, structures, and arrangements should fully support and enhance the implementation of the integrated management system.

The diagram below shows the relationship and interdependencies between various management practices within the integrated management system for improved organisational performance.

An integrated management system required for strategy execution and improved organisational performance should allow for more effective and efficient communication of information in the following directions:

- Vertically, either top-down or bottom-up, throughout organisational levels or layers.

- Horizontally with other business units, departments, sections, projects, and across value-chains and organisational boundaries.

- Holistically, from an enterprise-wide or portfolio perspective (across the organisation).

Governance

Governance is a guidance system for the achievement of objectives. It provides a logical structure within which management practices operate and are managed and controlled.

Parts of this structure may be mandatory and set by legislation, regulation, or listing rules in different jurisdictions, or by policy directives for public sector organisations. Others are discretionary set by boards and management, which can vary from organisation to organisation, even within the same statutory environment.

Having the appropriate governance structures and arrangements for strategy execution is vital for the success of the organisation in its quest to achieve its objectives and ultimately its corporate strategy.

Planning and stakeholder management

Planning is a critical management practice that involves setting SMART objectives and key performance indicators for the organisation, business units, departments, support functions, projects, and value chains. They provide the necessary baseline and guide for strategy execution.

Beyond that, plans should be flexible. They are constantly adapted to their context to achieve the intended outcomes. This is where an agile mindset is critical to ensure flexibility and adaptability of plans to changing context and circumstances.

Align all plans and processes to support the organisation’s strategic objectives.

Author

In each plan, there will be corresponding objectives and key performance indicators aligned to the overall achievement of the corporate strategy, taking into account applicable business-as-usual or stand-alone objectives that have not been cascaded down but appearing uniquely at various organisational levels (level or local objectives).

By actively engaging employees as key internal stakeholders and knowledge workers during strategy formulation and planning, individuals:

- Know what their important objectives and priorities are, especially from a time-management and prioritisation perspective.

- Can embrace these personal objectives and priorities ‘passionately’.

- Know what to do, especially through action plans.

- Have the ability, capacity, resources, and discipline to follow through on them.

Strategic planning is the process by which an organisation:

- Determines its objectives and key performance indicators.

- Determines its enterprise-wide risk appetite and tolerance thresholds.

- Identifies prioritised strategic initiatives necessary to achieve its strategic objectives and key performance indicators and resourcing them accordingly as a sign of management commitment.

- Understands opportunities, uncertainties, and risks associated with achieving its objectives and key performance indicators in line with the organisation’s risk appetite and tolerance thresholds.

Objective and KPI setting

Involving the doers should result in the necessary commitment to perform, guided by objectives and key performance indicators (KPI).

Executives and the doers should be personally involved in:

- Day-to-day (operational) or business-as-usual objective and KPI setting.

- Prioritising and choosing the required course of action and priorities based on (or linked to) defined corporate strategy, objectives, and key performance indicators that have been cascaded from the level above.

Organisations should develop performance tracking processes based on agreed informational sources and systems.

Reduce performance slack, disengaged employees, and excess capacity through stretched performance targets, appropriate workforce planning, and pay-for-performance reward systems.

KPI setting is inherently difficult. It takes a while to gather data and validate the key performance indicators’ cause and effect logic (i.e., causal relationship), measures, and targets. Unfortunately, many organisations have difficulties in quantifying their results or value drivers, especially from a cause and effect logical perspective.

Key performance indicators can also lose their validity and reliability when methods used for evaluating non-financial attributes are inconsistent across the organisation. For example, an organisation cannot track customer satisfaction at the individual client level when the organisation tracks employee performance at the business unit level. It is impossible to determine how individual employee performance can directly influence customer satisfaction when the level of analysis is different or inconsistent with each other.

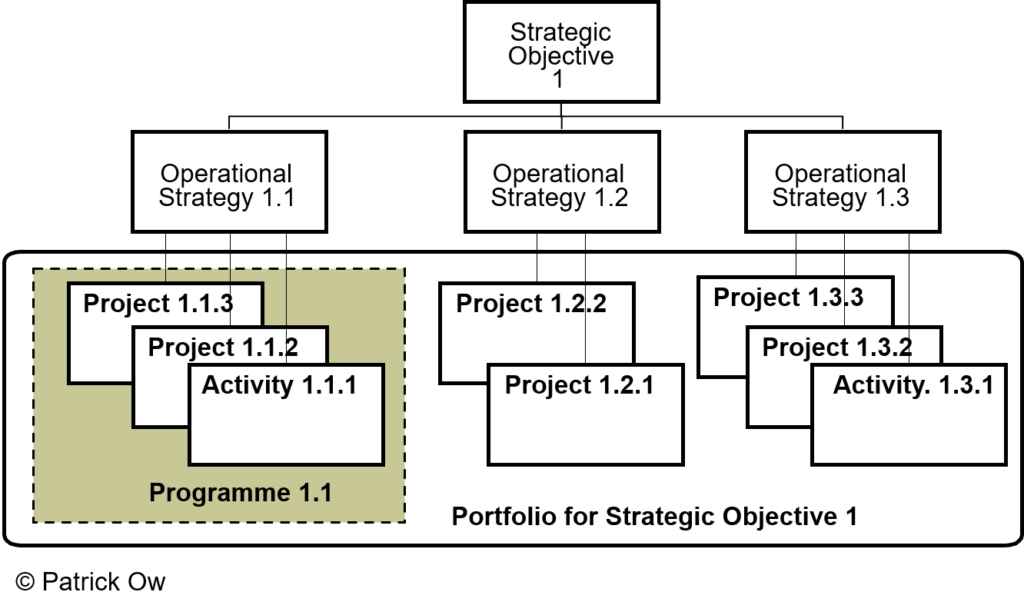

Portfolio, programme, and project management

Projects are effective means to deliver value to an organisation. Project-based organisations are organising their delivery of projects in the most effective manner, resulting in the emergence of programme and portfolio management.

Projects, programmes, and portfolios are vehicles to effectively execute the corporate strategy and improve organisational performance.

Collectively, they form a hierarchy of initiates as shown in the diagram below:

- A portfolio consists of programmes and projects that are managed at an organisational, programme, or functional level.

- Portfolio management is the selection and management of an organisation’s projects, programmes, and related business-as-usual activities.

- A programme is a temporary, flexible organisational structure created to coordinate, direct, and oversee the implementation of a set of related projects and activities to deliver outcomes and benefits related to the organisation’s strategic objectives.

- Programme management is the coordinated organisation, direction, and implementation of a group of projects and activities that together achieve outcomes and realise benefits that are of strategic importance.

- Programme opportunities, uncertainties, and risks are related to the effective transformation of the corporate strategy into shorter-term solutions and outcomes via a collection of projects or programmes.

- A project is a temporary organisation that is created to deliver one or more business products and services according to an agreed business case.

- Project management is the planning, monitoring, and control of all aspects of the project and the motivation of all those involved in it to achieve project objectives that are on time and to specified cost, quality, scope, and performance.

- Project opportunities, uncertainties, and risks are related to the efficient delivery of a product, service, or change, usually within the constraints of time, cost, scope, and quality.

Use a Project Management Office to oversee the management of projects, programmes, or a combination of both, focusing on the coordinated planning, prioritisation, and execution of projects (and activities) that are linked to strategic objectives.

The most important goals of portfolio management are:

- Portfolio value maximisation.

- The alignment with and achievement of strategic objectives.

- Portfolio balancing of individual components within the portfolio, especially within the boundaries of risk appetite and tolerance thresholds.

Resource management and budgeting

Proper allocation of resources through budgets will speak volumes. It shows a supportive organisation that does not pay lip service.

When a corporate strategy is important, executives must communicate this fact not only through words but also through actions.

Author

Budgets can serve at least six key functions if done correctly:

- Setting targets.

- Aligning incentives.

- Developing action plans.

- Allocating resources.

- Coordinating across all functions.

- Monitoring and controlling finances.

Resource management is the efficient and effective allocation and deployment of appropriate and sufficient organisational resources to support:

- Each level of accountability and authority.

- Individuals in achieving the required outcomes and strategic objectives.

Organisations should continuously optimise their cost structure and approach to resource allocation. They should invest in capabilities critical to organisational success and strategic performance. This includes proactively minimising or cutting costs in less critical or non-strategic areas to fund these strategic investments. It is about positively linking their strategic growth and cost agendas, not just cost-cutting.

When resources are allocated from the bottom up instead of from the top down, they get out of sync with what the senior team is trying to accomplish. This reflects the wrong allocation and ineffective strategy execution.

As with plans, constantly review and adapt budgets to the ever-changing context and competitive environment. Flexible resourcing and budgets are required based on the agile mindset.

Prioritise and resource all strategy-focused initiatives and activities. Note the following linkages:

- Link cross-organisational strategic initiatives to a dedicated strategic expenditure (STRATEX) budget. Protect that strategic money (or allocation) by creating special rules for allocating them. The CEO is the budget holder for this strategic budget. Strategic initiatives are organisational-wide programmes and projects outside the organisation’s day-to-day or business-as-usual operational activities, managed by dedicated strategic owners. All business units and support functions should participate collaboratively as a team in at least one strategic initiative.

- Link operational activities, projects, and programmes to day-to-day strategy-focused operational expenditure (OPEX) budgets and capital expenditure (CAPEX) budgets.

- Link future forecast for operating and capital expenditures to the strategy execution plan where there should be the allocation of sufficient resources in the future.

- Link controls to objective-focused risks where there will be the allocation of adequate resources for implementing risk treatment plans and maintaining existing controls.

Manage discretionary and non-discretionary spending separately by adopting zero-based budgeting that determines the minimum amount of non-discretionary expenditures needed to ‘keep the lights on’ throughout the organisation.

Create a separate rolling budget, a discretionary expenditure pool that can be allocated over the year rather than at a single point in the calendar. This flexibility is particularly important for volatile emerging markets and cyclical industries, where the benefits of moving resources quickly are often high. The rest of the spending should go towards strategic initiatives, based on strategic investment guidelines.

One of the most difficult parts of allocating resources is getting out of businesses that have served the organisation well in the past but are now stagnant or not performing. One useful approach is for the organisation’s investment committee (or similar) to conduct a formal exercise at least once a year imagining that the organisation is not in any of its businesses and then to ask whether the market fundamentals would make investments in each of them compelling.

Even without moving capital or people, organisations can shift management’s emphasis dramatically by taking a clean-sheet approach to the way executives spend their time. Set a time ‘budget’ for executives to clarify how much leadership capacity exists to ‘finance’ initiatives and whether management is focused on the highest strategic priorities.

Enterprise risk management

Identify and manage opportunities, uncertainties, and risks within the context of achieving objectives and within organisational risk appetite and tolerance thresholds. The organisation’s risk appetite and tolerance determine the type and amount of opportunity and risk an organisation is willing and able to accept in pursuit of its objectives.

Risk management is the foundation for the organisation’s control environment and sound corporate governance. It develops cost-effective plans that are at the same time the controls associated with achieving each objective.

Author

Effective risk management is about ensuring an organisation’s sustainably and success through:

- Managing opportunities, uncertainties, and risks that the organisation can control (regardless of how they may be defined, both good and bad).

- Adapting to opportunities, uncertainties, and risks that the organisation cannot control.

Apply the principle of cascading responsibility for performance to risk management. The underlying aim is to ensure that at all levels of the organisation, all employees:

- Understand the applicable risk appetite and tolerance thresholds in their area of responsibility and for the whole organisation.

- Are aware of the key opportunities, uncertainties, risks, and controls that may affect organisational performance and achievement of corporate strategy and strategic objectives especially in the area they are accountable for.

- Take responsibility and accountability for the management of those objective-focused risks and associated controls and budgets.

- Manage, monitor, and review performance, risks, controls, and budgets.

Risk management provides the required foundation for informed decision-making. The value of risk management is that it enables decision-makers across the organisation to make better quality, timely, and risk-informed decisions that are within the acceptable levels of risk. These decisions drive performance and should be the basis for every employee’s compensation and rewards.

The risk management process maintains the appropriate risk-based control environment that provides reasonable assurance to the board and management that objectives will be achieved within an acceptable degree of residual risk.

Reporting against performance measures and targets for each objective is also a report on the effectiveness of controls and the risk management process for that objective. Risk management reporting is therefore an integral part of performance reporting and it is not a separate exercise.

Enterprise risk management deals with opportunities, uncertainties, and risks affecting the organisation’s value creation (or preservation). It facilitates:

- An enterprise-wide view of risks and controls gained at a strategic level linked to the achievement of strategic objectives.

- A common understanding and management of these key enterprise-wide risks and controls, and the overall level of risk exposure, risk appetite, and the control environment within the organisation.

- An integrated but synchronised response to multiple risks across the organisation, especially from a holistic perspective.

- An effective organisational-wide response to the potential interrelated impacts, threats, and opportunities

- Achievement of strategic objectives and key performance indicators within the board-approved corporate risk appetite and tolerance thresholds.

This contemporary risk management strategy will require a centralised, integrated, and enterprise-wide approach to risk management that will enable:

- Every employee to understand the organisation’s risk appetite, risk tolerance, performance targets, and where are the ‘edges of the envelope’ for each business line, product, geographic unit, and value chain.

- Every employee to operate at or near the ‘edges of the envelope’ without crossing the line, where risk-takers (e.g., executives) take a measured risk without crossing the line and risk-averse employees (e.g., doers) take on more measured or acceptable risk to reach the line.

- Employees to raise issues (known knowns) and identify risks (known unknowns) for discussion and management without fear of repercussions within a positive organisational culture of mutual trust and respect.

- Fearless and objective reporting of performance (or non-performance), variances, compliance, budgets, and lessons learned.

- Every business unit within the organisation to assess, monitor, and manage residual risks in a consistent way.

There needs to be greater opportunities and accountabilities for managing operational risks and controls at lower organisational levels. This leaves executives to manage strategic risks and controls that matter most to the organisation. Strategic risk cannot be easily delegated.