Family decision-making and risk management

Families are changing in many ways across many countries and continents. The notion of what constitutes a ‘family’ has changed. Even the term ‘family’ is difficult to define. There are now traditional and non-traditional models of ‘family’. And different or new models may emerge in the future.

The traditional family life cycle generally consists of five phases:

- Bachelorhood – Young singles adult living apart from parents.

- Honeymooners – Young married couple.

- Parenthood – Married couple with at least one child living at home.

- Post parenthood- An older married couple with no children living at home.

- Dissolution – One surviving spouse.

The challenges are different in each phase, but the decision-making process is the same.

There are also non-traditional models of ‘family’. They include:

- Childless couples – It is increasingly acceptable for married couples to elect not to have children.

- Couples who marry later in life (in their late 30s or later) – More career-oriented men and women and greater occurrence of couples living together. They are likely to have fewer or even no children.

- Couples who have a first child later in life (in their late 30s or later) – They are likely to have fewer children.

- Single parent I – High divorce rates contribute to a portion of single-parent households.

- Single parent II – Young man or woman who has one or more children.

- Single parent III – A single person who adopts one or more children.

- Extended families

- Young single adult who return home to avoid the expenses of living alone while establishing their careers.

- Divorced daughter or son and grandchild return home to parents.

- Frail elderly parents who move in with their children.

- Newlyweds living with in-laws.

- Unmarried couples – This includes heterosexual and homosexual couples.

- Divorced persons (no children) – High divorce rate contributes to the dissolution of relationships before a child is born.

- Single persons (most are young) – Primarily a result of delaying first marriage. This includes men and women who never marry.

- Widowed persons (most are elderly) – Longer life expectancy, especially for women, means more over 75 single-person households.

These traditional and non-traditional models of ‘family’ have brought about different but significant challenges in terms of family decision-making and how opportunities, risks and uncertainties are managed within the ‘family’ unit.

Families are confronted with a myriad of decisions. Some very complex and sensitive decisions. Many decisions inherently come down to personality, values, mutual concessions and compromises, and commitment to the relationship.

When two or more people enter a relationship, the number of decisions they should make on their own decreases significantly because their respective decision circles overlap. Nearly every decision you make individually in a relationship has an impact on the other person. For couples, to maintain a healthy relationship, each partner must at least consider their spouse when making decisions. For families, each member of the family must consider each other’s feelings and requirements.

Therefore, many family decisions are often subject to a great deal of conflict and uncertainty. This requires a practical decision-making process that people can use and apply in resolving their conflicts and overcoming their situational uncertainty.

Family risk management brings to families a proven system of risk management like the risk management processes routinely used by businesses and other commercial organisations. In some respects, the discipline of such a process is even more necessary in a family than in a business because emotional and personality considerations can easily lead to important issues being avoided or poor-quality decisions being made. This results in poor outcomes.

There is no reason why you can’t apply corporate risk management to your own family, outside of your work. You may need the right tools to make informed decisions and may require assistance in doing so.

Family problems come in all shapes and sizes.

- Instrumental problems involve everyday decisions about money or transporting the children to and from school.

- Affective issues are concerned with a family member’s feelings and emotions.

For example, getting a child to daycare for the first time may require dealing with instrumental issues regarding transportation and affective issues regarding the child’s fear of being left at a strange place for the first time.

One of the keys to successful family functioning is the family’s ability to solve problems.

Families with a decision-making process in place are more likely to resolve both types of issues. It is important for families who become stuck and are unable to resolve an issue to learn and implement this process.

Having a simplified easy to use decision-making process like PrOACT 31000 can go a long way in minimising conflicts, maximising positive outcomes and increasing the quality relationships. The conscious act of applying the relevant PrOACT 31000 elements to your situation and decision-making will ensure that informed decisions are made under uncertainty and risk. And that opportunities and risks are identified and managed accordingly.

A personal trainer can walk alongside you in applying PrOACT 31000 in your current family situation. This can lead to better decision-making. There are many risk management strategies and tools available that you could use to manage your family risks and make better-informed decisions.

The hierarchy of individual needs

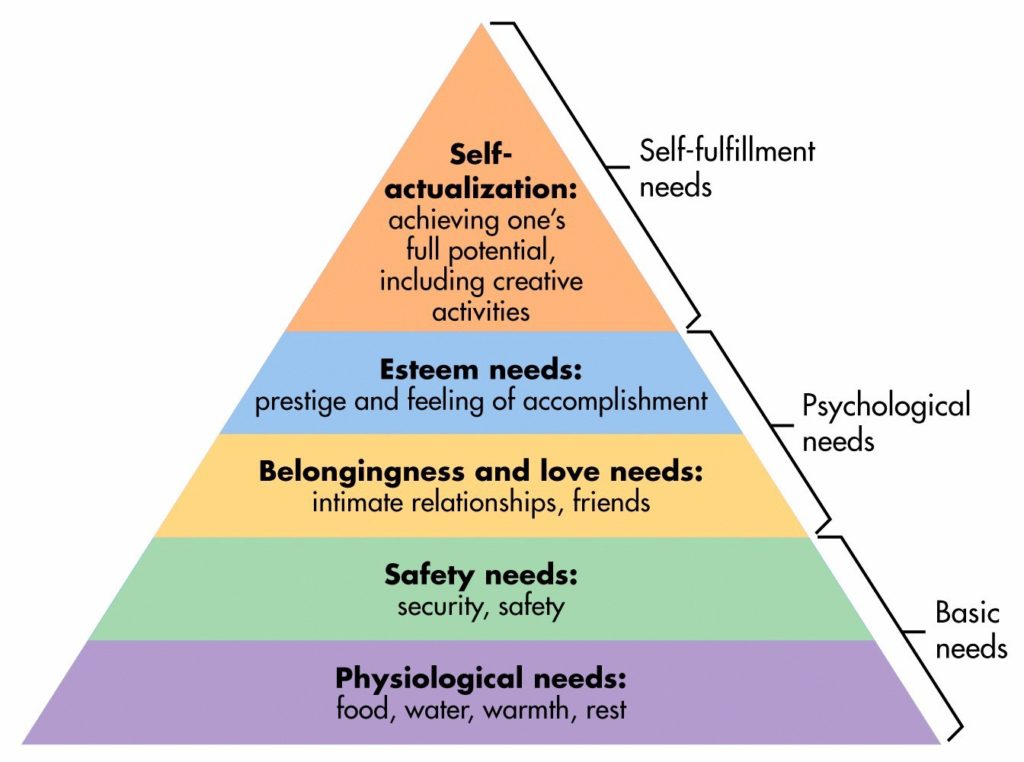

Psychologist Abraham Maslow (1908-1970) believed that all people had needs. He created a hierarchy of needs – physiological, safety, love, esteem, and self-actualisation. According to Maslow’s theory, people cannot work to satisfy their higher-order needs for knowledge, art, and personal growth until their most basic needs are met, as shown in the diagram below.

Although later research does not fully support all of Maslow’s theory, his research has impacted other psychologists and contributed to the field of positive psychology. For this article, it helps use unpack and understand the different levels of needs that individuals have and must navigate across.

At the basic level, your safety and security needs include:

- Personal security.

- Emotional security

- Financial security

- Health and well-being

Everyone needs money at this basic level. No one can survive without it. Without money, you cannot afford necessities such as accommodation, food, and clothing.

Money or income generated from your work or effort is a means to an end. It is not the end itself, at least for many people. While money cannot buy happiness, money is required to fund those activities that will make you happy especially at the higher levels.

Hierarchy of financial needs

Therefore, corresponding to Maslow’s hierarchy of needs is the hierarchy of financial needs:

- Income to cover basic needs – The most basic financial need at this basic level is some money or income to cover your daily living expenses of food, shelter, and clothing.

- You need income from your job, business, or investments to fulfil your most basic physiological needs before you can move on to the next level up in your hierarchy of needs.

- At this basic level, cash flow and money management are crucial skills to acquire or learn.

- Income and personal protection – Once you have sufficient money or income to cover your basic needs, protect yourself, your income stream, and your assets that produce income.

- Protect yourself with income protection, disability, life, and health insurance. Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

- Income protection insurance pays you a regular benefit amount if you are unable to work for an extended period.

- Disability cover is a form of living insurance that is designed to protect in the event of a temporary or permanent disability, caused by an illness or injury.

- Life insurance provides a lump-sum payment to your beneficiaries when you die or are diagnosed with a terminal illness that will result in death within 12 months. It’s designed to help loved ones to cope financially when someone dies.

- Private health insurance provides financial cover for all or part of the cost of various health-related treatments and services.

- Invest in your career and personal development to secure your future employment. Upskill yourself with key skills, competency and experience required by employers to remain employable, moving with the times and seasons. Constantly position yourself for the future to enable you to be continuously earning an income.

- Protect your assets with auto and home insurance.

- Home and contents insurance is designed to cover you financially should something happen to your home and belongings.

- Car insurance protects you from any car accidents.

- Protect yourself and your family with business insurance if you are a business owner. Business insurance can help pay the costs of property damage, lawsuits, lost business income, and other covered losses.

- Professional indemnity insurance provides some protection for your business against certain claims for damages resulting from your negligent act, error, or omission while you’re working for a client.

- Personal accident insurance can cover you for lost income if you suffer an injury or illness that prevents you from performing your regular work and earning your usual income.

- Public liability insurance can help protect you if you become liable to pay compensation for injury to third parties, or damage to their property, during your work. It can help protect you in the event of claims for personal injury or property damage that a third party suffers because of your business activities.

- Business property insurance helps protect your business’s buildings and personal property. This might include furniture, tools, equipment, and inventory.

- Business income insurance helps replace lost income if you close temporarily due to a covered loss like theft or property damage from a fire. It can also help you continue paying expenses while your property is replaced or repaired.

- Workers’ compensation insurance helps cover costs to employees while they are unable to work after suffering a work-related injury or illness.

- A commercial auto policy helps protect your business from the costs of a work-related auto accident. If you or an employee is in an accident while driving for business reasons, commercial auto can help cover the costs that result from the accident.

- Employment practices liability helps protect your business if an employee sues you.

- Home-based business insurance helps cover the costs of property and liability risks to businesses that operate out of a business owner’s home. If you keep supplies, equipment, or other business property at your home, or have customers stopping by, consider adding this coverage.

- Data breach insurance helps your business respond to a data breach if personally, identifiable information gets lost or stolen.

- Create an emergency fund as a source of ready cash and cash-flow in case of an unplanned expense, loss of a job, a debilitating illness, or a major repair to home or car. Financial planners recommend that emergency funds should typically have three to six months’ worth of expenses in the form of highly liquid assets.

- Create an estate plan that includes legal documents that are effective during your lifetime while you are still alive (i.e., power of attorney) as well as other documents that aren’t in effect until your death (i.e., wills). Depending on the legal jurisdiction, the type of legal documents may vary:

- In the event you become incapacitated (i.e. while you are still alive), a financial power of attorney names an agent to handle your financial affairs until you recover or until your death (at which time your will takes over).

- A health-care power of attorney appoints an agent to make medical decisions on your behalf in the event you cannot make them yourself, especially when you are hospitalised or in a coma.

- A power of attorney for a child is a document that appoints an agent to care for your children temporarily and lawfully. It can go into effect for a specific duration or begin as soon as an event happens, such as if one or both parents become incapacitated and being unavailable.

- A will details where you want your assets to go at your death, and who you would like to serve as guardian of your minor children. A Last Will and Testament is an important estate planning document that individuals use to outline how they wish their estate to be distributed after they die. It also names an executor who oversees the distribution of your assets to the right people or charities. If you die without making a valid will, you leave what is known as an intestacy. This means you have not validly disposed of some or all your assets. If you die without a will, your assets will be distributed according to a legal formula. It also means that you have no control over who distributes your assets.

- Protect yourself with income protection, disability, life, and health insurance. Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

- Asset accumulation – Once you have personal and income protection at the second level and income to cover your basic needs at the first level, it’s time to grow your wealth or accumulate your assets by investing for future returns.

- Acquire a portfolio of income-producing assets like real estate, stock/share trading/investing, businesses, and websites to diversity your risk and future income streams.

- Real estate investing involves the purchase, ownership, management, rental and/or sale of real estate for profit.

- Stock trading is about buying and selling stocks for short-term profit, with a focus on share prices. Investing is about buying stocks for long-term gains. If the company grows and becomes more valuable, the share is worth more – so your investment is worth more too. Some shares pay you part of the company’s profits each year, called a dividend.

- You could also invest in index funds and exchange-traded funds (ETFs).

- Website investing is the act of acquiring a website solely to earn have hierarchy of gboth income and cash flow. The goal would be to have the website be a form of digital real estate.

- Paying off debts including your credit card debt is a form of savings too.

- Retirement fund or superannuation like a 401(k) plan is a workplace retirement account that’s offered as an employee benefit. This account allows you to contribute a portion of your pre-tax income to tax-deferred investments. This reduces the amount of income you must pay taxes on that year.

- Acquire a portfolio of income-producing assets like real estate, stock/share trading/investing, businesses, and websites to diversity your risk and future income streams.

- Enhancing and enjoying your life – Save or invest for specific goals that will enable you to do the things that bring joy into your life – i.e., volunteering, long vacations, family activities and entertaining friends.

- Financial independence – At this level, you can live on the income generated from pensions, investments, or passive income such as dividends, royalties, and rental income. It often refers to the retirement years. It can also mean the freedom to work how, when and where you like. At this level, you are not worrying about money. You could make charitable donations to a cause you believe in or help your children or grandchildren with their education expenses.

The seven life areas

There are seven life areas that you need to balance and spread your actions to live an effective but balanced life:

- Social and family relationships.

- Career and educational aspirations.

- Money and personal finances.

- Physical health, recreation, and leisure.

- Life’s routine responsibilities.

- Giving back to society and contribution.

- Mental, emotional, and spiritual health.

For each of these seven life areas, you can have a hierarchy of goals or objectives that you may want to achieve based on Maslow’s hierarchy of needs.

Desmond Tutu once wisely said that “there is only one way to eat an elephant: a bite at a time.” What he meant by this is that everything in life that seems daunting, overwhelming, and even impossible can be accomplished gradually by taking on just a little at a time.

Don’t regret living a fulfilled life

An Australian nurse who spent several years working in palliative care recorded her patients dying epiphanies in a book called The Top Five Regrets of the Dying.

The top five regrets of the dying:

- I wish I’d had the courage to live a life true to myself, not the life others expected of me – “This was the most common regret of all. When people realise that their life is almost over and look back clearly on it, it is easy to see how many dreams have gone unfulfilled. Most people had not honoured even a half of their dreams and had to die knowing that it was due to choices they had made, or not made. Health brings a freedom very few realise, until they no longer have it.”

- I wish I hadn’t worked so hard – “This came from every male patient that I nursed. They missed their children’s youth and their partner’s companionship. Women also spoke of this regret, but as most were from an older generation, many of the female patients had not been breadwinners. All of the men I nursed deeply regretted spending so much of their lives on the treadmill of a work existence.”

- I wish I’d had the courage to express my feelings – “Many people suppressed their feelings in order to keep peace with others. As a result, they settled for a mediocre existence and never became who they were truly capable of becoming. Many developed illnesses relating to the bitterness and resentment they carried as a result.”

- I wish I had stayed in touch with my friends – “Often they would not truly realise the full benefits of old friends until their dying weeks and it was not always possible to track them down. Many had become so caught up in their own lives that they had let golden friendships slip by over the years. There were many deep regrets about not giving friendships the time and effort that they deserved. Everyone misses their friends when they are dying.“

- I wish that I had let myself be happier – “This is a surprisingly common one. Many did not realise until the end that happiness is a choice. They had stayed stuck in old patterns and habits. The so-called ‘comfort’ of familiarity overflowed into their emotions, as well as their physical lives. Fear of change had them pretending to others, and to their selves, that they were content, when deep within, they longed to laugh properly and have silliness in their life again.”

Hierarchy of objectives

Progressively over time, strive for higher-level objectives as your financial situation improves. Avoid regrets in your life.

Your hierarchy of objectives might be as follows:

- Get more organised and be smarter with money.

- Provide financially to ensure appropriate living standards for the family.

- Upgrade the family home to gain more space and live in a great location.

- Maintain a successful family business or to maintain or enhance employment or career.

- Prepare for the financial challenges that will arise when starting or growing a family.

- Protect the family from the unexpected.

- Grow the value of family wealth.

- Pay down the mortgage.

- Preserve family unity and prevent dispute.

- Contribute back to the community.

- Establish and uphold a lasting family legacy.

Risk to family objectives

There are financial and non-financial risks associated with the achievement of these objectives in each of seven life areas and at different levels of the hierarchy from a risk management perspective.

- Financial risks include the possibility of an absolute loss, a failure to meet objectives or falling below minimum benchmarks.

- Many families can also be exposed to investment risk through poor investment management.

- The increasing cost of healthcare can be a potential risk to families.

- Non-financial risks could include damage to the family reputation, a major family dispute, loss of family values and work ethic, or the destruction of a family legacy.

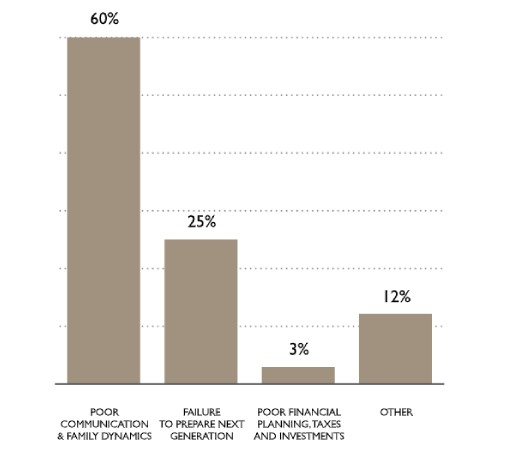

Poor communication and family dynamics and a failure to prepare the next generation are noted family risks that have caused wealth destruction for many families, as shown below:

Other non-financial related risks faced by families are health-related risks that include:

- Access to health care

- Anxiety disorders and post-traumatic stress disorder

- Attention deficit and hyperactivity disorder (ADHD)

- Behaviours

- Chronic illness, lifestyle diseases, diabetes, etc.

- Dementia

- Disabilities

- Drugs and alcohol

- HIV/AIDS

- Immunisation

- Injury and violence

- Mental health

- Overweight and obesity

- Physical activity, nutrition, Eating disorder

- Sexuality and sexual disfunction

- Substance abuse

- Tobacco

Identify and manage these risks to your family and achieve your objectives. There is no reason why you can’t apply corporate risk management to your own family, outside of work.

Decision-making in families

Families are confronted with a myriad of decisions. It includes decisions to purchase products and services, selection of educational practices, choice of recreational activities, use of disciplinary practices, and deployment of limited resources.

The family decision-making process is a communication activity. This communication may be explicit (as when families sit down and discuss a prospective decision) or implicit (as when families choose an option based on their past decisions or some other unspoken rationale). It could be a process that can be filled with tension, extremely pleasant and rewarding, both. Or it could be somewhere in between.

It should be noted that family decisions can often be subject to a great deal of conflict. Conflicting pressures are especially likely in families with children or when only one partner works outside the home.

Frequently, there no “objective” way to arbitrate differences. One partner may believe that it is important to save for the children’s future. The other may value spending now (on private schools and computer equipment) to help prepare the children for the future. Who is right? There is no clear answer here.

The situation becomes even more complex when more parties — such as children, grandparents, or other relatives — are involved.

One of the keys to successful family functioning is the family’s ability to solve problems.

The following are some tips to help with family decision-making:

- Avoid discussing an issue or problem at an inappropriate time – Problem-solving tends to be difficult when people are angry or tired. Have a discussion when everyone is calm.

- Do not begin the decision-making process with a closed mind – You may be surprised at the creative solutions your family creates together when everyone is open.

- Be sure to listen to other people’s viewpoints, feelings, and concerns – Agree to disagree. Respect people and minimise conflicts. Consider the big picture.

- Clarify to make sure you understand correctly and not make assumptions – Always check to make sure everyone is on the same page.

- Do not let anger become a barrier to progress or a positive outcome – Getting angry, criticising, calling names, blaming, using sarcasm or other aggressive behaviour does not help. If you are angry, take a break.

- Do not give in just because it is easier – Saying, “You’re right” with a big sigh, or being submissive to avoid conflict is not problem-solving. Its avoidance.

- Be realistic – Try to attach decisions to resources such as time, energy, and money.

- Avoid ultimatums – Ultimatums threaten other people into submitting to what they want. For example, “You’ll do it or I’ll divorce you!”

- Be respectful – Refusing to regard individual differences in personalities, goals, values, emotional investments, and lifestyles do not encourage teamwork.

- Communicate directly – Using a middle person to communicate with another family member can cause even more emotions to flare and can lead to misunderstandings.

- Be involved in family decisions – If you do not take an active interest in decisions that concern other members of the family, which could benefit by your involvement, do not be hurt when others are disinterested in your problems.

- Establish suitable boundaries around family decision-making. Determine who will be involved in the process: immediate family, extended family, in-laws, etc.

- Solving problem as they arise – Competent families solve problems as they arise; whereas, families that avoid problem-solving, or seem incapable of dealing with many of their problems have more difficulties.

Joint decision-making

There are three principles that you must live by as you go through a joint decision-making process:

- Communication – Understand one another’s perspective. Let others tell you what they see and what they believe to be true. Understand that their input is valuable and contributes significantly to the outcome, the final decision.

- Respect – When one member of your family makes his or her own decisions, you must openly and wholeheartedly respect their judgement and allow them the freedom to succeed or fail on their own.

- Trustworthiness – When making your own decisions, you must consistently show others in your family that you can make good decisions on your own. It is what you do consistently that makes a lasting change.

Decision-making in relationships is a great litmus test for the health of your relationship.

Ultimately, the personal decisions you make will define who you are individually and who you are within your family. When the foundation of a relationship is built upon the pillars of communication, respect, and trust, then it is bound to succeed.